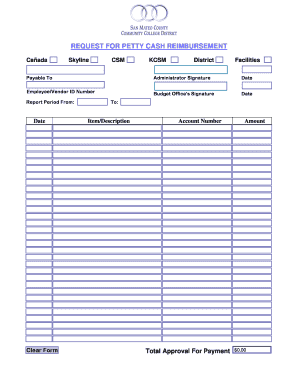

This voucher signifies the purpose of the expenditure, the date, and the name of the person receiving the money. To create a petty cash fund, a verify is written to cash for a set quantity corresponding to $75 or $100. Nonetheless, preserving important quantities of money at hand can have some dangers. Firm must record expenses on the earnings statement and enhance the petty cash steadiness to $ 500.

Petty Cash Fund Journal Entry: Mastering Flawless Information

Cash transactions are some of the widespread activities inside any company. Normally, these involve paying varied events or receiving cash from them. Assume that on March 1, 2024, the business decides to decrease petty money by $200, for a complete decrease of $600. Explore how cash circulate management software might help you track each transaction—no matter how small—and hold your funds correct and audit-ready. That’s why it’s necessary to automate management which will save you time and increase accuracy. This consists of logging the expense, amassing a receipt, and noting who used the funds and why.

Accounting For Petty Money

- For many small companies, this may mean a fund between $100 and $500.

- A shortage means the cash and receipts combined are less than the preliminary petty cash fund amount.

- While not specific to petty money, money schemes, including larceny, are widespread fraud sorts.

- A petty cash voucher or a respectable third-party receipt serves as the primary proof for any disbursement from the petty money fund.

- It provides a detailed, date-stamped document of every occasion the petty money fund is established, replenished, or adjusted.

- The elegance of the Imprest System lies in its inherent design for sturdy monetary control and streamlined operations.

Imagine needing to send an pressing parcel or buying petty cash reimbursement journal entry espresso for a consumer meeting—these small transactions, while individually minor, can quickly accumulate. With Out a petty money fund, each of those would necessitate a time-consuming check request or reimbursement course of, hindering productivity and creating pointless administrative burden. Its main operate is to simplify these micro-transactions, permitting operations to circulate seamlessly without interruption. Nonetheless, petty cashiers can not spend cash from the account with out receipts.

Implementing Strong Inner Controls On Your Petty Money Fund

Petty money steadiness after reimbursement reverts to again to the level of the float. Here are some regularly asked questions about recording petty cash transactions using a petty money journal entry. This ought to make clear any lingering questions after reading the guide https://www.kelleysbookkeeping.com/.

In this case, the money wanted to get back to $100 ($100 fund – $7.forty petty cash on hand) of $92.60 equals the total of the petty money vouchers. Each enterprise has small, everyday bills that have to be paid on the spot—things like office supplies, minor repairs, or employee reimbursements. Instead of going via an extended approval course of for every little value, firms maintain a petty money fund to cowl these fast funds.